Today, everything happens online, from ordering food to booking flights or buying clothes, and behind every successful payment, there’s a system working silently: the payment gateway.

If you’re new to e-commerce or simply curious, this blog breaks down a payment gateway, how it works, and how you can add one to your Website. You will learn about integrating a payment gateway into your Website and even creating one if you’re considering building your own.

What Is a Payment Gateway?

A payment gateway is like a virtual bridge connecting your online store to your customer’s bank.

It securely transfers payment information from the buyer to the bank and back to the store to confirm whether the payment was successful.

How Does a Payment Gateway Work?

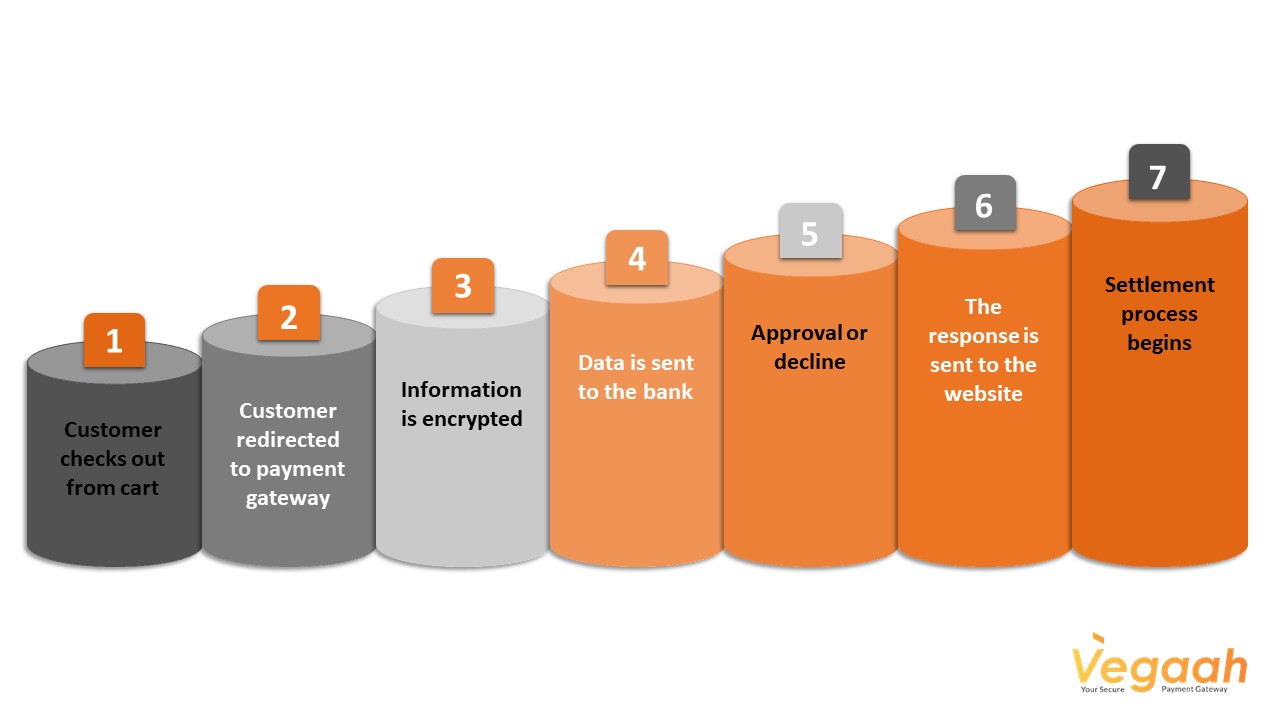

Here’s a simple step-by-step explanation:

1. Customer Pays on the Website: They enter card details or choose UPI/net banking on the merchant’s website.

2. Customer Redirected to Payment Gateway: Once they enter the details, they are redirected to the payment gateway

3. Information is encrypted: The payment gateway converts sensitive data into secure code.

4. Data is sent to the Bank: The gateway sends this data to the bank for authorization.

5. Approval or Decline: The bank verifies details and approves or declines the transaction.

6. The response is sent to the Website: The merchant (store owner) gets a success or failure message.

7. Settlement Process Begins: Once approved, the money moves from the customer’s bank to the merchant’s account (this may take 0–3 working days).

How to Add a Payment Gateway to a Website?

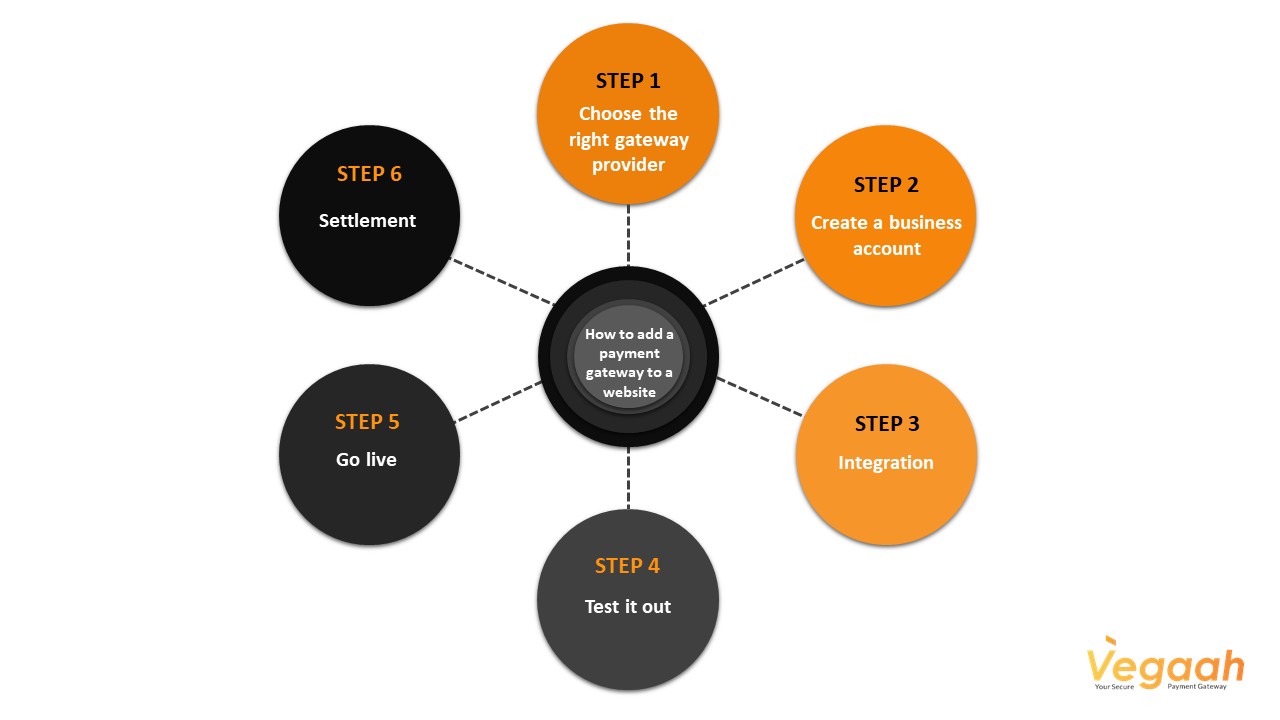

If you’re running an online business, you must know how to add a payment gateway to a website. The process isn’t as complicated as it sounds:

1. Choose the Right Gateway Provider: Look for one that fits your business size, customer base, and preferred payment methods.

2. Create a Business Account: Register your business with the gateway provider and submit documents such as your PAN, GST, and bank details.

3. Integration: The provider gives you tools like plugins or APIs for payment gateway integration. You (or your developer) will use these to connect the payment system to your Website.

4. Test It Out: Before going live, always run a few test payments to ensure everything works smoothly.

5. Go Live: Once tested and approved, your site can start accepting real-time payments.

Most platforms, such as WooCommerce and Magento, offer straightforward steps to integrate payment gateways, making them beginner-friendly.

Fintech companies usually do this, and it’s not necessary for most e-commerce sellers. Instead, a trusted provider like VegaaH can save you time, cost, and legal hassle while offering a secure and seamless experience.

Why Is a Payment Gateway Important?

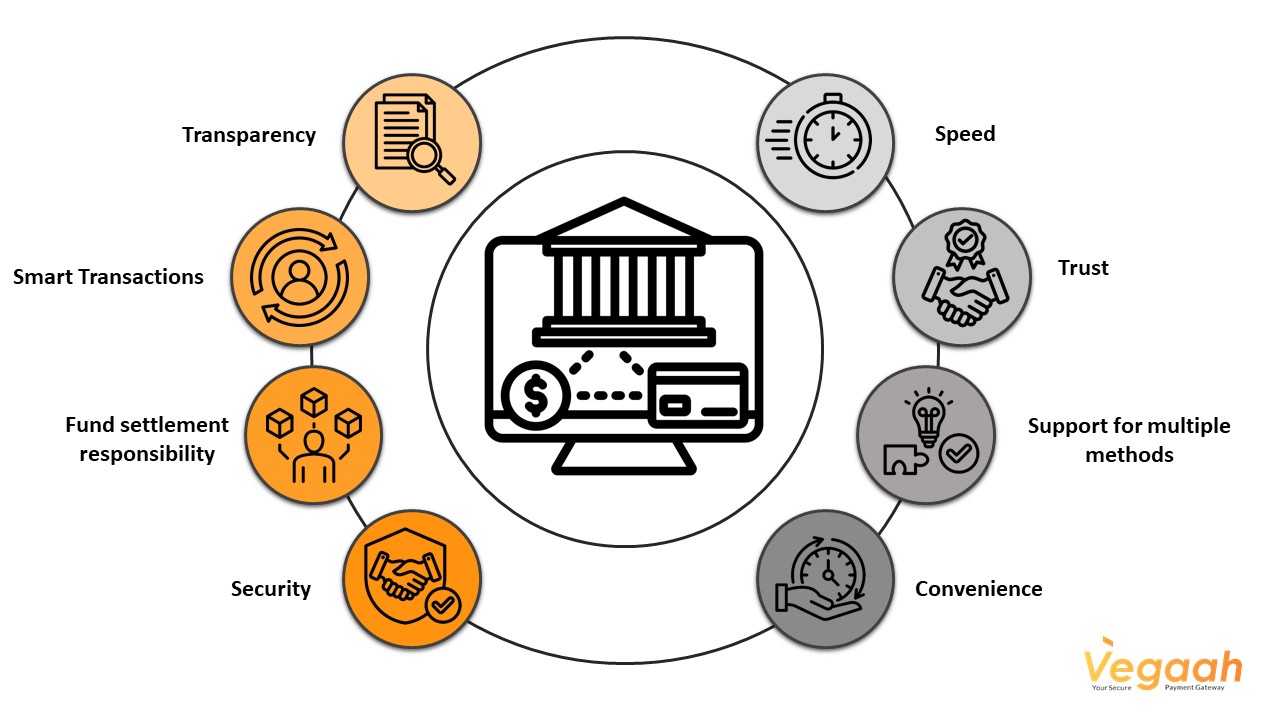

Transparency: It provides more information, which leads to transparent transactions.

Smart Transactions: It enables seamless online purchases for buyers.

Security: It protects both the buyer and the seller from fraud.

Speed: Transactions are processed within seconds.

Trust: Customers feel more comfortable when payments are smooth.

Support for Multiple Methods: Cards, UPI, wallets, and net banking all in one place.

Convenience: Payments happen anytime, from anywhere.

You can’t run a modern e-commerce store without a payment gateway.

A payment gateway is a tech tool, and it’s a key part of the online shopping experience. It ensures that transactions are safe, fast, and reliable.

If you’re running a business, learning how to integrate a payment gateway into your Website is necessary. You don’t need to be a tech expert; many platforms simplify it. And if you’re ever in doubt, reliable providers like VegaaH can guide you through setup, integration, and support.

Vegaah is 3DSecure 2.3 Visa & MasterCard Certified, offering a simple intuitive web console for merchants, payment retry, one-step payment, faster checkout, multiple payment modes, multiple currencies supported on the Payment page, and settlements.

So, the next time someone asks you what a payment gateway is, you’ll have a clear answer with an example. And if you’re building an online store, now’s the time to give your customers the ease and trust they deserve.

FAQs

| 1. What is a payment gateway in simple terms? A payment gateway is a tool that lets your website accept online payments securely from customers |

| 2. Why do I need a payment gateway for my website? It ensures payments are fast, secure, and reliable, helping build trust and increasing your sales. |

| 3. How does a payment gateway keep transactions secure? It encrypts sensitive data, so your customer’s card or bank details are safely transferred during payment. |

| 4. Can I create my own payment gateway? Technically, yes, but it’s complex. It requires bank tie-ups, licenses, and top-level security. Most businesses use a trusted provider instead. |

| 5. What is the difference between UPI and a payment gateway? UPI is a real-time payment system for instant bank transfers via mobile apps, mainly used by individuals. A payment gateway is a platform that helps merchants accept and process various payment methods, including UPI, on their websites or apps. |